What Is the Best Approach for a Single Proprietorship Business

A sole proprietorship is a less complex type of business than an LLC and its simplicity is its greatest advantage. As a sole proprietor you are not considered a separate legal entity.

However you may have to file what is known as a Doing Business As certificate with the state if you choose to run the business under a name that is different from your given name.

. There is no legal separation between the business and the owner which means the. One of the first issues you should consider is how many owners your business will have and how involved each of the owners will be in the day-to-day management of the company. Here are some of the benefits of setting your business.

That lemonade stand at the corner of your street is an example of a sole proprietor business. However I would recommend to contact community colleges technical schools and vocational training centers. Sole proprietorship has a simple structure and its common among small restaurants and family-owned businesses.

Because you and your business are one and the same the business itself is not taxed separately-the sole proprietorship income is your income. Despite its simplicity a sole proprietorship offers several advantages including the following. Costly Mistakes to Avoid When Determining The Best Entity for your Amazon FBA Business or Other E-Commerce Business.

For many small businesses the best initial choice is either a sole proprietorship or if more than one owner is involved a partnership. Sole proprietorship is one of the most popular business types in the foodservice industry and its when a business is owned by a single individual. Pros of Sole Proprietorship.

In general a sole proprietorship is the most straightforward option and quicker to set up. The business will not have a wide range of customers but rather a small dedicated group. You must choose an original name.

That means using your personal credit cards. As you use your personal credit cards you will jack up your revolving debt which will drive down your personal credit score. However the establishment of such a type of business is easy simple and follows no legal formalities required like private company registration.

Answer 1 of 5. The bottom-line amount from. If you are planning on growing your business fast and issuing stock you would do the best to incorporate your business as a C Corp in which case you will have to pay corporate taxes.

You have to add something to your question otherwise you leave it to the personal agenda of the answerer. Answer 1 of 7. You file an LLC or Corporation online for 99 and you have ZERO protection because all you filed with the IRS was the articles and EIN.

It is the simplest and most popular form of business start up because it is so easy. The sole proprietor structure costs nothing to form. Todays environment makes it difficult to find skilled construction workers due to the pandemic.

Your freelancer friend working on Toptal is also a sole proprietor. You have a registered agent but nothing else. What begins as a sole proprietorship may be transformed into another more complex business structure such as a corporation if the business grows substantially and begins hiring a sizeable number of employees.

You generally dont have to register a sole proprietorship with the state. When considering the tax and legal advantages of a sole proprietor vs LLC structure the LLC wins. When you operate as a sole proprietorship in the US you will self-finance the business if you need credit.

Its the default business type whenever you start something as a single person. If you own the business by yourself you can operate a sole proprietorship a single-member LLC or a. However choosing a sole proprietor structure means you will not have the same legal and tax advantages that a single member LLC provides.

This flexibility in business formation makes and LLC a great choice for many small businesses especially game developers. An attorney might say the answer in my mind is almost always yes to forming an entity when planning to run. Best approach for a single proprietorship business - 5381476 A.

By simply starting your business activity you are considered to be in business. As the name suggests a sole proprietorship is owned and operated by a single natural person. A sole proprietorship perhaps the easiest way of starting a business is nothing more than the proprietor itself.

Advantages of a Sole Proprietorship. An LLC can even be a single-member entity in some states effectively replacing the sole proprietorship with a form that offers benefits for the sole entrepreneur. An LLC which you can form as a single owner called a single-member LLC comes with other advantages including a separation of your business and personal assets and liabilities and the ability to file taxes as an S Corp which could mean tax savings at.

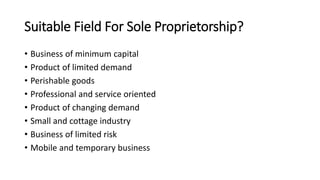

You report income andor losses and expenses with a Schedule C and the standard Form 1040. However this simplicity comes with certain limitations. A sole proprietorship is best suited to small businesses with low risk and low profits.

The paperwork required to get started is minimal. For numbers 1-5 choose the correct theme of the given showsprogramsvideos. Sole proprietorship is a popular option among solopreneurs in the United States.

An LLC is a different type of business entity and one of the most popular business models for small businesses with fewer legal requirements and many of the same benefits as an S Corp. On the first approach a sole proprietorship is best suitable for startups who are looking to operate on a small scale and want to enjoy unlimited liability. It cannot already be claimed by another business.

There is always the possibility of contacting employment agencies.

Sole Proprietorship Or Llc Sole Proprietorship Business Business Bank Account

Reading Sole Proprietorship And Partnerships Introduction To Business

Llc Vs Sole Proprietorship Here We Provide You With The Top 7 Differences Between Llc Vs Sole Sole Proprietorship Real Estate Tips Social Media Marketing Plan

No comments for "What Is the Best Approach for a Single Proprietorship Business"

Post a Comment